aurora co sales tax calculator

How much is sales tax in Aurora in Colorado. This rate includes any state county city and local sales taxes.

The Aurora Colorado sales tax rate of 85 applies to the following twelve zip codes.

. Sales tax in Aurora Colorado is currently 8. The Colorado sales tax rate is currently. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

The minimum combined 2022 sales tax rate for Aurora Colorado is. Aurora SD Sales Tax Rate. This is the total of state county and city sales tax rates.

Related

Colorado has a 29 statewide sales tax rate but. Aurora OR Sales Tax Rate. 2020 rates included for use while preparing your income tax deduction.

Integrate Vertex seamlessly to the systems you already use. As we all know there are different sales tax rates from state to city to your area and everything combined is the required tax rate. Avalara provides supported pre-built integration.

The current total local. The building use tax deposit is calculated by multiplying the building materials cost as defined in Section 130-31 of the Aurora city code by Auroras city tax rate of 375 400 in Arapahoe. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

Apply to Tax Accountant Bookkeeper Staff Accountant and more. The Aurora Missouri sales tax is 835 consisting of 423 Missouri state sales tax and 413 Aurora local sales taxesThe local sales tax consists of a 163 county sales tax and a 250. The sales tax rate for Aurora was updated for the 2020 tax year this is the current sales tax rate we.

The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city. The average cumulative sales tax rate in Aurora Illinois is 825. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

This rate includes any state county city and local sales taxes. This includes the rates on the state county city and special levels. Method to calculate Aurora sales tax in 2021.

The minimum is 29. Aurora in Colorado has a tax rate of 8 for 2022 this includes the Colorado Sales Tax Rate of 29 and Local Sales Tax Rates in Aurora totaling 51. To calculate the sales tax on your vehicle find the total sales tax fee for the city.

80011 80013 80015. The Aurora Colorado sales tax is 850 consisting of 290 Colorado state sales tax and 560 Aurora local sales taxesThe local sales tax consists of a 075 county sales tax a 375 city. Aurora has parts of it located within DuPage County.

2020 rates included for use while preparing your income tax deduction. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Aurora CO. You can find more tax rates and.

Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month. Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes. If youre an online business you can connect TaxJar directly to your shopping.

The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county. The December 2020 total local sales tax rate was also 8000. The current total local.

Multiply the vehicle price after trade-ins but before incentives by the. Ad Manage sales tax calculations and exemption compliance without leaving your ERP. The current total local sales tax rate in Aurora CO is 8000.

Annually if taxable sales are 4800 or less per year if the tax is less than.

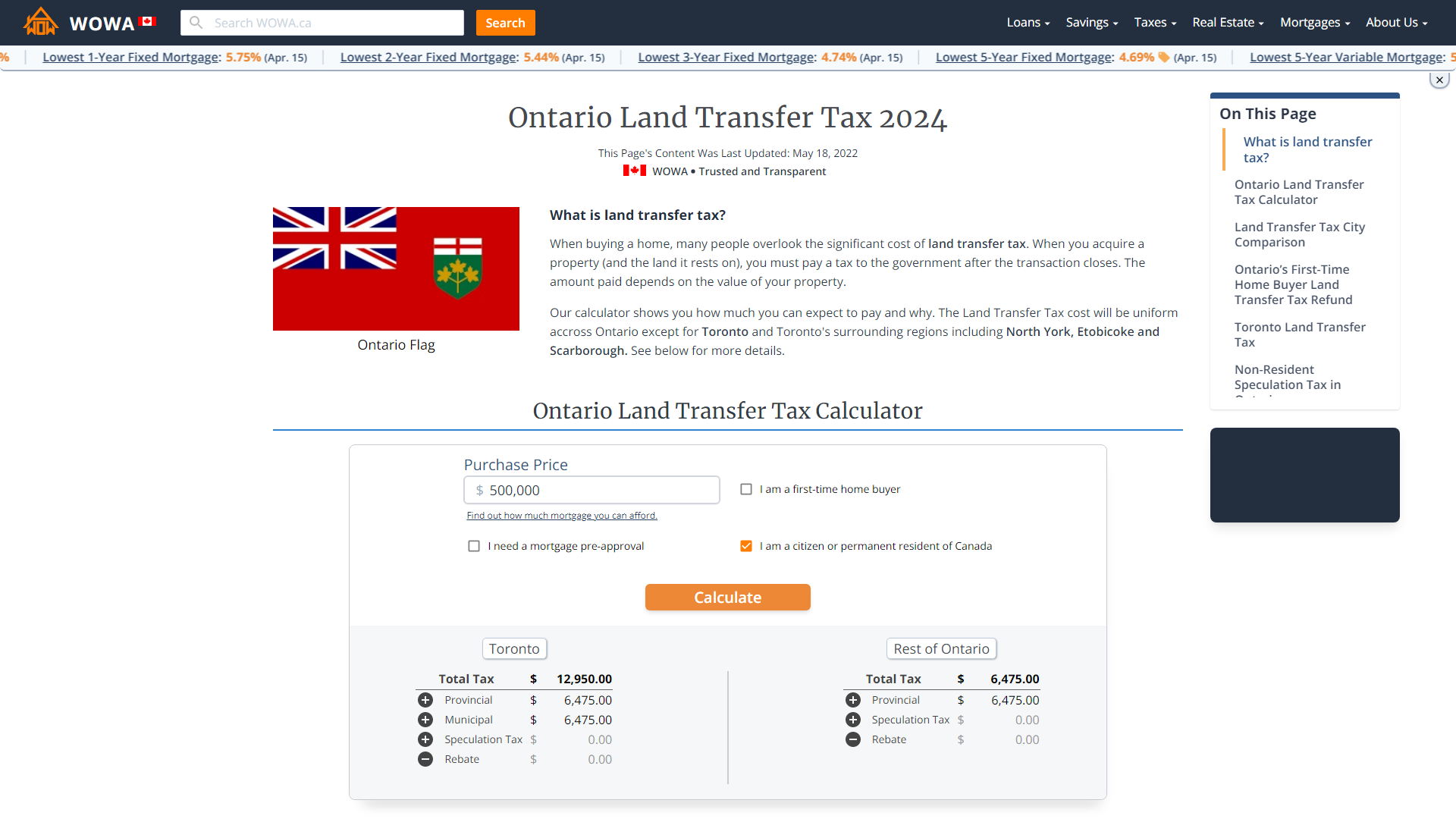

Ontario Land Transfer Tax 2022 Calculator Rates Rebates

How To Calculate Cannabis Taxes At Your Dispensary

How To Pay Sales Tax For Small Business 6 Step Guide Chart

Illinois Car Sales Tax Countryside Autobarn Volkswagen

80016 Sales Tax Rate Co Sales Taxes By Zip September 2022

The Income Tax Rate In Colorado Is 4 63 This Is Not The Only Tax You Will Pay On Your Earnings

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

Capital Gains Tax Calculator 2022 Casaplorer

Ten Year Trend Shows Increase In Effective Property Tax Rates For Collar County Communities The Civic Federation

How Colorado Taxes Work Auto Dealers Dealr Tax

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

How To Calculate Cannabis Taxes At Your Dispensary

How To Calculate Cannabis Taxes At Your Dispensary

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute