texas estate tax return

3 However not every estate needs to file Form 706. These additional forms returns apply to certain.

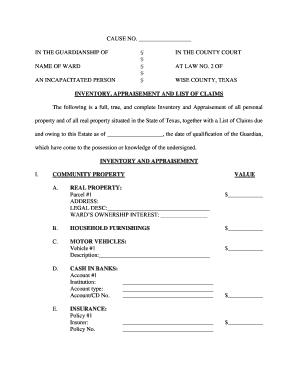

Probate Inventory Form Texas Fill Out And Sign Printable Pdf Template Signnow

Natural Gas Tax Forms.

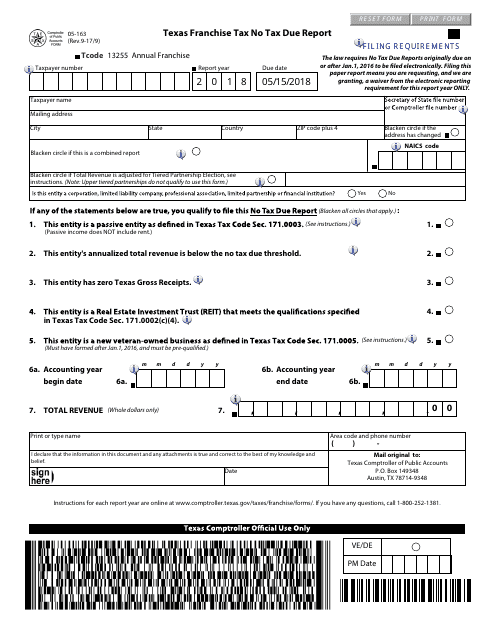

. Before filing Form 1041 you will need to obtain a tax ID number for the estate. If you as executor decided to go by. The law requires all No Tax Due Reports originally due after Jan.

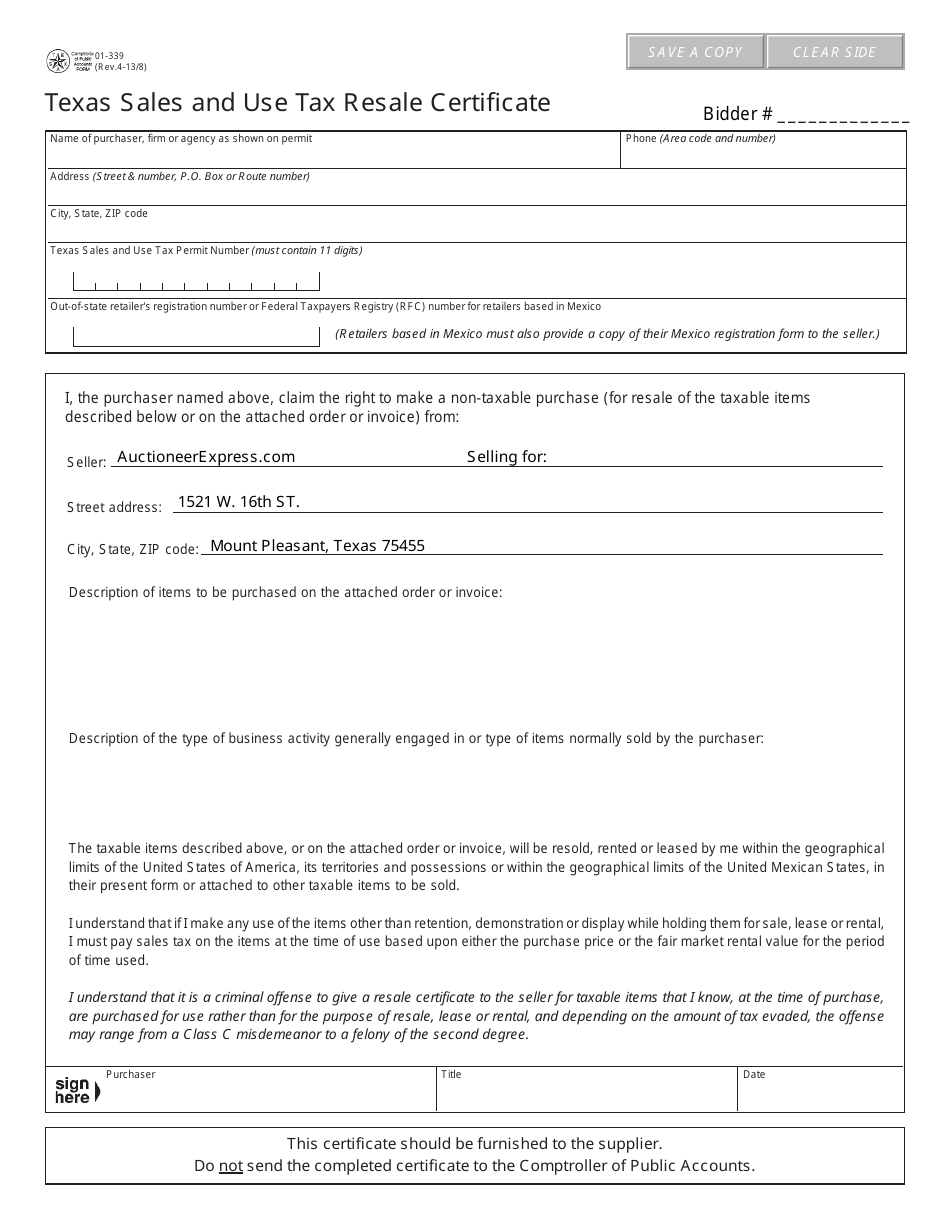

For Uncle Bartholomew if the tax year began in June when he died it would end on May 31 of the subsequent year. 01-118 Texas Sales and Use Tax Prepayment Report PDF 01-142 Texas Off-Road Heavy Duty Diesel Equipment Surcharge Return PDF Use Tax Return. On it youll report estate income gains and losses and will claim deductions for the estate.

Supplemental forms such as 706-A 706-GS D-1 706-NA or 706-QDT may also need to be filed. For 2022 the federal estate tax exemption is 12060000 and the top federal estate tax rate is 40. But it TurboTax says I have to file a state business income tax return in Texas.

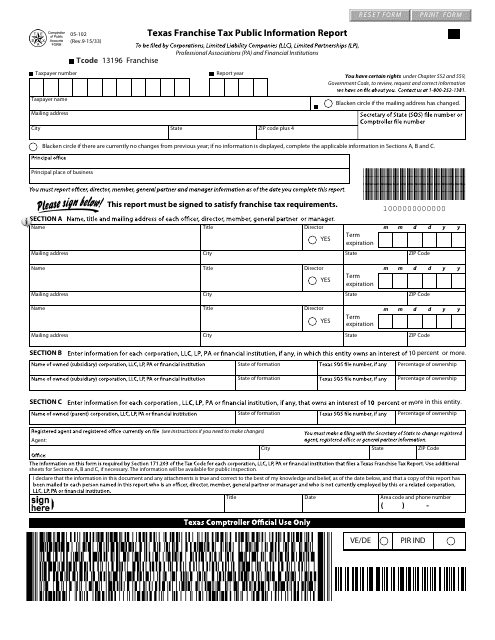

For more information please visit the Texas Comptroller website. Federal Estate Tax. Sexually Oriented Business Fee Forms.

Regardless of the size of your estate you wont owe estate taxes to the state of Texas. In the state of Texas you also need to file an inheritance tax return if the estate is large enough. 31 rows Filing Estate and Gift Tax Returns When to File Generally the estate tax return is due nine months after the date of death.

If you move outside of Texas or own real estate in a state outside of Texas however you may be. But dont forget estate tax that is assessed at the state level. You can also apply by FAX or mail.

The gift tax return is due on April 15th following the year in which the gift is made. Underage Smoking Regulatory Forms. TurboTax has no info on your website.

Form 706 must generally be filed along with any tax due within nine months of the decedents date of death. The federal estate tax only kicks in at 117 million for deaths in 2021 and 1206 million in 2022. Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005.

Near the end of the interview procedure TurboTax stated. One on the transfer of assets from the decedent to their beneficiaries and heirs the estate tax and another on income generated by assets of the decedents estate the income tax. Tobacco Cigar Cigarette and E-Cigarette Forms.

A federal state local and foreign income gift payroll Federal Insurance Contributions Act 26 USC. The good news is that Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Mixed Beverage Tax Forms.

Texas is one of seven states which do not levy a personal income tax. The sales tax is 625 at the. Power of Attorney Forms.

It includes information on tracking estate planning documents final arrangements real estate and tax records. You might owe money to the federal government though. You must also file a federal income tax return on the decedents behalf.

Form 706 estate tax return. Texas state and local governments generate revenue primarily from sales tax and property tax. 0 1 773 Reply.

Texas estate planning electronic resource With fingertip access to hundreds of forms along with explanations of how to best apply these forms Texas Estate Planning assists you in preparing client wills trusts durable powers of. The executor or administrator is required to among other things prepare and file all of the tax returns due both for the decedent and for the estate. The return is filed under the name and taxpayer identification number TIN of the estate.

See How to Apply for an EIN. The estate income tax return is due on the fifteenth day of the fourth month after the end of the tax year. Based on Texas law if an estates value estate exceeds 114 million you need to submit an estate tax return before you can finalize the estate.

Texas ended its state inheritance tax return for all persons dying on or after January 1st 2005. Each are due by the tax day of the year following the individuals death. Executors attorneys and accountants fees administration and other miscellaneous expenses can be claimed as a deduction on the estates income tax return Form 1041 if a waiver is filed on the Form 706 example.

1 2016 to be filed electronically. His assets were held in a living trust that became an irrevocable trust upon his death. Access IRS Tax Forms.

September 15 would be the fifteenth day of the fourth month following that date. You can apply online for this number. An estates tax ID number is called an employer identification number or EIN and comes in the format 12-345678X.

01-163 Texas Use Tax Return PDF - for New Off-Highway Vehicles Purchased. Thankfully less than 1 of Americans will have an estate tax issue. Texas has a state sales tax rate of.

You are required to file a state business income tax return in. If the estate lasts for two or more years after the date of the decedents death it must pay an estimated tax in the same manner as individuals. 01-156 Texas Use Tax Return PDF - to report.

Residents of Texas must still file federal Form 1040 or Form 1040SR each year. Up to 25 cash back The executor of the estate is responsible for filing a Form 1041 for the estate. Complete IRS Tax Forms Online or Print Government Tax Documents.

Complete Edit or Print Tax Forms Instantly. Chapter 21 and other tax returns. Income earned during the estate administration is reported on IRS Form 1041 Fiduciary Income Tax Return.

This return must be filed if gross income of the estate is 600 or more. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Up to 25 cash back You as executor can file the estates first income tax return which may well be its last at any time up to 12 months after the death.

Ad Download or Email IRS 1041 More Fillable Forms Register and Subscribe Now. How do I file Texas taxes for an estate The reference is probably to the Texas Franchise Tax but you do not have to file for an estate. The 1041 federal return was for the estate of my father who died in the middle of 2018.

You dont have to include a copy of the will when you file the return. A six month extension is available if requested prior to the due date and the estimated correct amount of tax is paid before the due date. The language conferring authority with respect to tax matters in a statutory durable power of attorney empowers the attorney in fact or agent to.

No personal income tax states. It depends on the value of the estate. There is a.

1 Best answer Accepted Solutions. 1 prepare sign and file. The state business return is not available in TurboTax.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. A Closer Look The Matter of Texas Probate Taxes. So until and unless the Texas legislature changes the law which is always a possibility youll likely not owe any Texas inheritance or estate tax.

What Is The Probate Process In Texas A Step By Step Guide

Texas And Tx State Individual Income Tax Return Information

Talking Taxes Estate Tax Texas Agriculture Law

Form 01 339 Download Fillable Pdf Or Fill Online Texas Sales And Use Tax Resale Certificate Texas Templateroller

Form 05 102 Download Fillable Pdf Or Fill Online Texas Franchise Tax Public Information Report Texas Templateroller

2021 Extended Tax Returns Texas Franchise Due Date Beaird Harris

Form 05 163 Download Fillable Pdf Or Fill Online Texas Franchise Tax No Tax Due Report 2018 Texas Templateroller

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Free Texas Real Estate Property Power Of Attorney Form Pdf Word

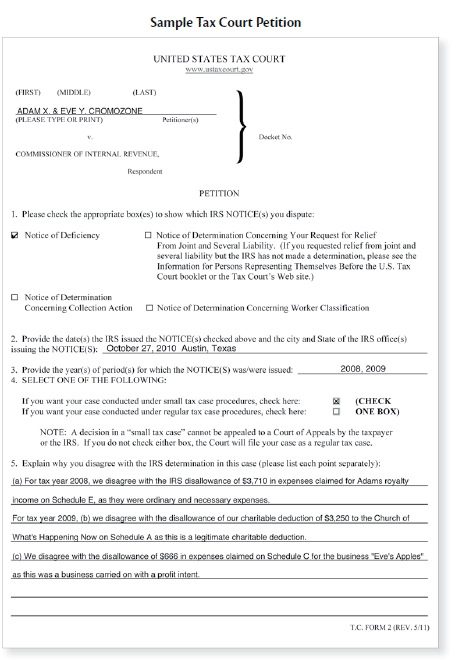

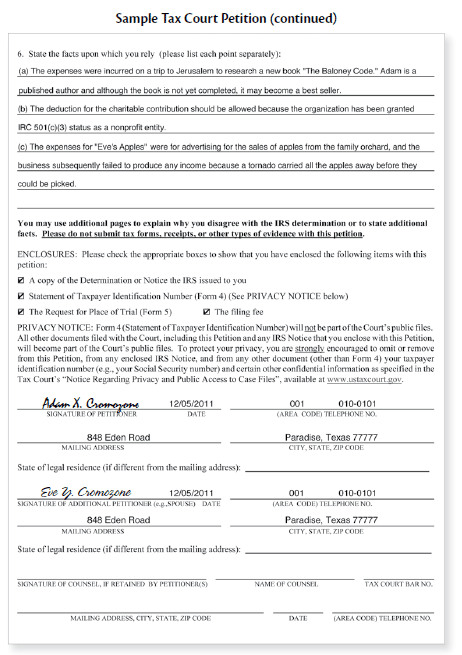

Irs Tax Court Standing Up To The Irs Law Offices Of Daily Montfort Toups

Texas Inheritance And Estate Taxes Ibekwe Law

Here S When Married Filing Separately Makes Sense Tax Experts Say

Texas State Taxes Forbes Advisor

Texas Inheritance Laws What You Should Know Smartasset

/WheretoGetaMoneyOrder-7e5ce5ccbac84b39aaa04b5aba66a961.jpg)

Form 709 United States Gift And Generation Skipping Transfer Tax Return

/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-01-c5d6697fa005491f8a0049780f7c2b82.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Irs Tax Court Standing Up To The Irs Law Offices Of Daily Montfort Toups